It is know secret that Pharmaceutical companies make a killing world wide. The United States accounts for more than a third of the global pharmaceutical market, with $340 billion in annual sales followed by the EU and Japan. Just in 2020 alone Pharmaceuticals Market to Reach USD 1,310.0 Billion in 2020; Eruption of the COVID-19 Pandemic to Accelerate the Demand for Effective Treatments and Drugs Worldwide: Fortune Business Insights.

In 2019 the Combined total profits for these companies was about $744 Billion. -All 13 pharmaceutical companies spent a total of $643 Billion on research. -The total amount they spent on marketing was about 60% more than what they spent on research: $1.04 Trillion. The overall economic impact of the bio-pharmaceutical industry on the U.S. economy is substantial. The industry accounted for more than $1.3 trillion in economic output, representing 4 percent of total U.S. output in 2015 alone.

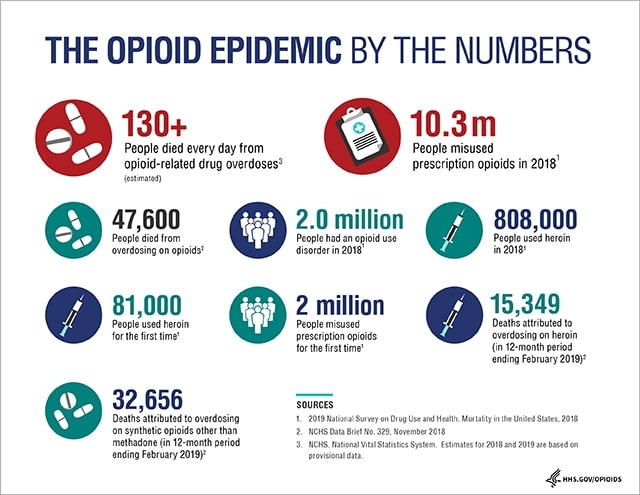

With a record 47,600 opioid overdose deaths in 2017: A new study linked drug companies’ marketing for opioid painkillers to more. Opioid painkillers aren’t the sole driver of overdose deaths in the US — particularly as illegal opioids, like illicit fentanyl and heroin, have taken off — though they’re still involved in 40 percent of opioid overdose deaths, according to the study. Whether and how more opioid prescriptions may lead to other kinds of opioid overdose deaths needs to be studied further, the researchers cautioned.

The opioid epidemic can be understood in three waves. In the first wave, starting in the late 1990s and early 2000s, doctors prescribed a lot of opioid painkillers. That caused the drugs to proliferate to widespread misuse and addiction — among not just patients but also friends and family of patients, teens who took the drugs from their parents’ medicine cabinets, and people who bought excess pills from the black market.

A second wave of drug overdoses took off in the 2000s when heroin flooded the illicit market, as drug dealers and traffickers took advantage of a new population of people who used opioids but either lost access to painkillers or simply sought a better, cheaper high. And in recent years, the US has seen a third wave, as fentanyls offer an even more potent, cheaper — and deadlier — alternative to heroin.

It’s the first wave, though, that really kicked off the opioid crisis — and it’s where marketing for opioid painkillers is likely most relevant. (The study, however, could only look at recent data, because similar statistics don’t exist for prior years. So we don’t know if things are getting worse or better when it comes to marketing.)

Over the past few years, we’ve seen more and more reports about opioid companies aggressively marketing their products, even as it became clearer that the drugs weren’t the safe, effective alternative to other painkillers on the market that they claimed opioids to be.

Billions of taxpayer dollars go into the creation and marketing of new drugs. The Los Angeles Times reports that, “Since the 1930s, the National Institutes of Health has invested close to $900 billion in the basic and applied research that formed both the pharmaceutical and biotechnology sectors.” Despite taxpayers’ crucial investment, U.S. consumers are increasingly paying more for their prescription drugs.

A 2018 study on the National Institute of Health’s (NIH) financial contributions to new drug approvals found that the agency “contributed to published research associated with every one of the 210 new drugs approved by the Food and Drug Administration from 2010–2016.” More than $100 billion in NIH funding went toward research that contributed directly or indirectly to the 210 drugs approved during that six-year period. The NIH Research Project Grant which supports health-related research—was by far the most common kind of grant used to fund the science that supported the new drugs. In all, NIH gave out nearly 118,000 grants related to those drugs from 2010 to 2016.

The top 10 pharmaceutical companies, ranked by revenue:

- Pfizer — $51.75 billion

- Roche — $50 billion

- Novartis — $47.45 billion

- Merck — $46.84 billion

- GlaxoSmithKline — $43.54 billion

- Johnson & Johnson — $42.1 billion

- AbbVie — $33.27 billion

- Sanofi — $27.77 billion

- Bristol-Myers Squibb — $26.15 billion

- AstraZeneca — $23.57 billion